━ Investment Philosophy

Building Wealth with Real Risks in Mind

Welcome to my take on investing—forged from years overseas where bad calls had real consequences, not just paper losses. This isn’t textbook theory or Wall Street hype. It’s a straightforward approach shaped by history, geopolitics, and personal accountability, aimed at long-term resilience over quick wins. Below, I lay out how I invest and why, focusing on what endures in a world of shifts and distortions.

━ Radigan Carter Investment Philosophy

My Core Principles

Investing isn’t about stacking cash for its own sake—it’s a tool for freedom and a beautiful life.

I prioritize assets that hold value through chaos, drawing from lessons like ancient trade routes or modern power struggles. Here’s what guides me:

Long-Term Horizon

Think in generations, not quarters. Allocate like you’re building for 100 years, balancing scarcity, durability, and productivity to weather volatility.

Real Risk Awareness

Treat uncertainty as a constant—geopolitical tensions, policy distortions, or elite missteps can upend markets. I confront them head-on, inspired by historical reckonings like failed armadas or shifting global consensus.

Personal Responsibility

Strength matters. Be robust mentally, physically, and financially—your investments should support that, not chase endless growth at the cost of your physical health and sanity.

Global Perspective

Overseas experiences taught me to spot overlooked edges, from energy dynamics to labor shifts. Avoid arrogance; understand how interconnected forces affect your world.

Balanced Life Focus

Wealth serves joy and resilience, not the other way around. Integrate investing with habits that build a life worth living—free from fluff, rooted in what truly compounds.

━ How I Invest?

Radigan Carter's Investment Strategy

My strategy keeps it simple: focus on what you control, learn from mistakes, and adapt. I invest my own money, so every choice is battle-tested.

Key elements include:

- Asset Allocation: Favor durable holdings like gold or treasuries that hedge against inflation and systemic breaks, informed by patterns like globalization’s fallout or power transitions.

- Risk Management: Evaluate probabilities first—geocode tensions or demographic shifts—before details. Diversify across borders, but stay grounded in personal impact.

- Avoiding Noise: Cut through recycled advice and culture wars distractions. Prioritize facts over narratives, holding up your corner of the world without running from problems.

- Continuous Learning: Draw from history and poetry, like "The Gods of the Copybook Headings," to remind us reality always reasserts itself—prepare accordingly.

The Fortress

- Periodic free updates notified by email

- 12 Monthly Investing Letters

- Access to all past letters archive

- Insights from real mistakes and lessons

30-Day Money Back Guarantee,

No Questions Asked.

━ Join The Fortress

Join The Fortress TOday!

For $150/year, get monthly letters showing my moves, plus audio for on-the-go insights.

Dive deeper and build with me.

— Jack

— Jill

— Jarred

— Damian

— Lara

━ Latest Dispatches

Start Using My Investing Wisdom for Free

Money builds a better life—freedom, resilience, beauty. Dive into my real, free lessons, distilled weekly—right now!

Radigan carter

some more text, bla bla bla asdasd asdasd asd as da sd asd...

14 min read

14 min read

Recommendation

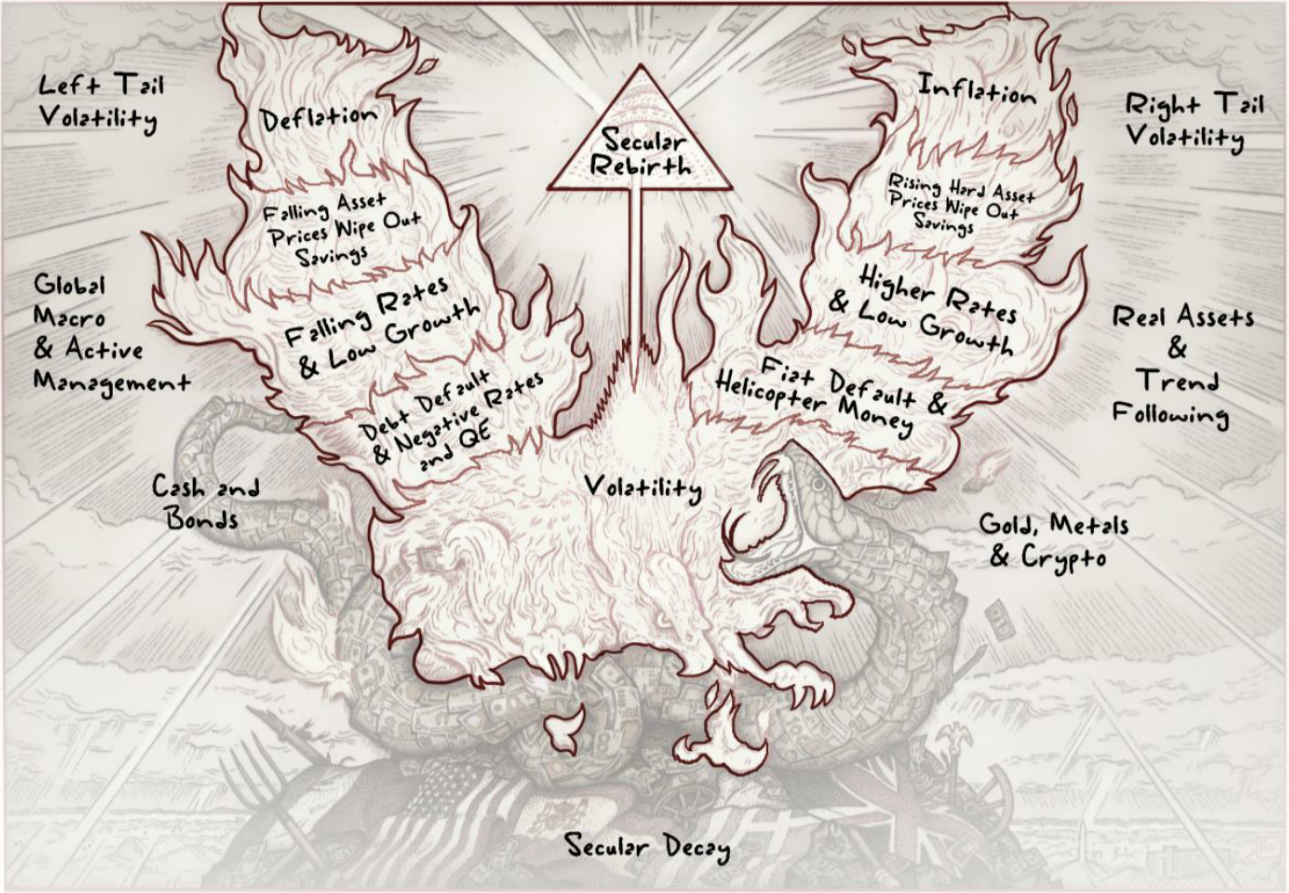

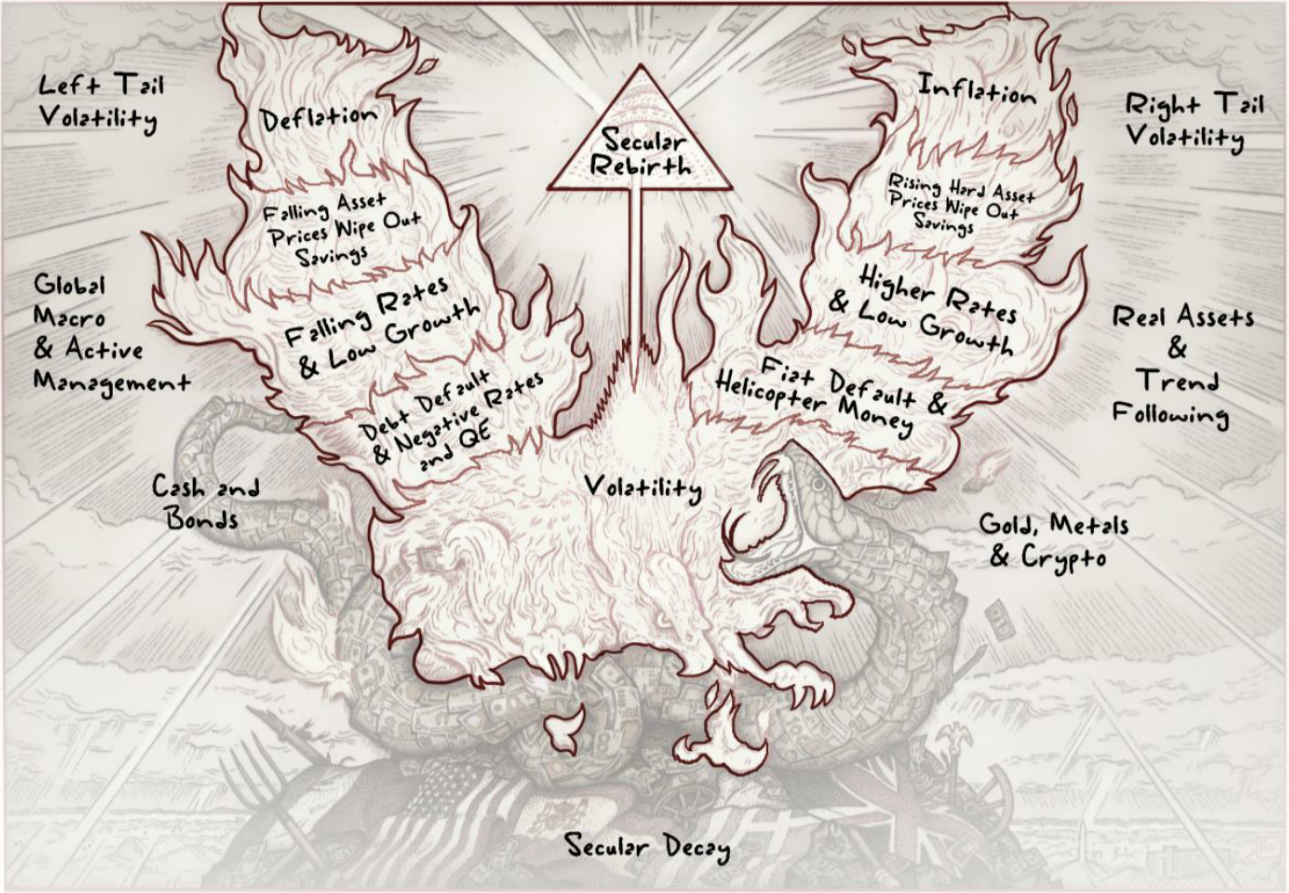

Published by Artemis Capital, the paper looks at allocating assets for 100 years “Imagine you ha...

14 min read

14 min read

Notes On The Allegory Of The Hawk and the Serpent

Published by Artemis Capital, the paper looks at allocating assets for 100 years “Imagine you ha...